Meeting Managements in Japan: Why did we go?

We recently met more than 20 companies during our research trip to Japan. Over the past three weeks, we have been writing about some of the interesting companies that we met during that trip. By revenue, Japan currently makes up 19.3% of the Pathfinder International Fund. We started investing in Japanese stocks in 2015 but really took the weight up in 2019 and 2020. We thought that we would take this issue of the Pathfinder Investment Outlook to explain our Japanese thesis and why we have made such a significant investment in this country. Many investors might know about Japan’s “Lost Decades”, which was a prolonged period of economic stagnation that began in the early 1990s and continued into the 2010s. First, there was an asset bubble in real estate and the stock market. This was followed by a huge crash in the early 90’s. Then there was a banking crisis, zombie companies that the government would not let fail, deflation and a demographic crisis. All of this led to stagnation and structural issues. However, we believe there are many reasons to consider good quality Japanese companies as investment options.

• Japan has remained a significant part of the global economy. In fact, even today, after the US, China, and the European Union, Japan remains the 4th largest economy in the world.

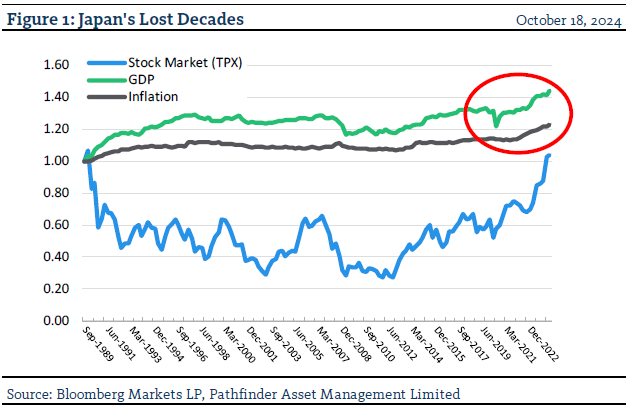

• Recently, the country has emerged from 40 years of deflation and stagnant growth (Figure 1, red circle).

• There has been a change in corporate governance, which makes the country more investable. While there are still some issues with information transparency, corporate behavior has increasingly aligned with the norms of developed markets (buy backs & less cross-ownership for example).

• Many companies offer excellent value, and the market is just breaking highs set 40 years ago (Figure 1, blue line). Furthermore, while many companies are Japanese based, they are selling outside of their domestic economy and into other dynamic environments, thus, offering diversification and potentially an under appreciated cash flow stream.

“This means that” we expect to further build out our allocation to Japan. There are 3,000 companies in Japan and many of them do not have significant investor following. In our opinion, investors who are willing to do a little work will be able to uncover some great businesses. We believe this is an excellent opportunity for the International Fund.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.