It’s already the end of the year….

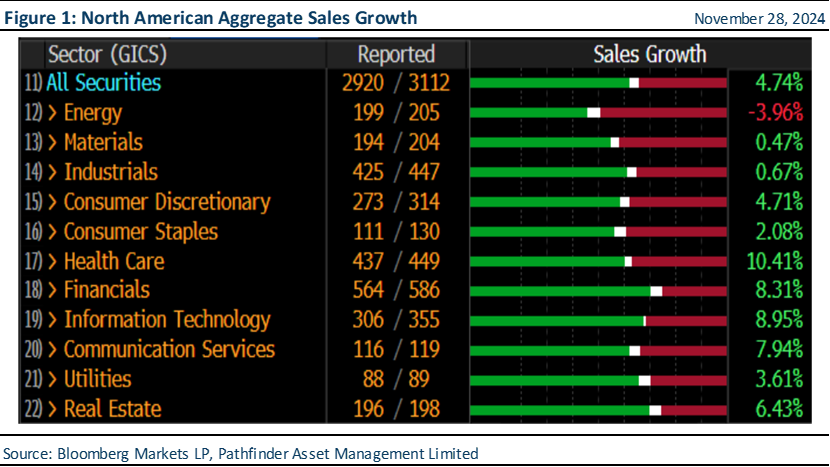

As regular readers of the Pathfinder Investment Outlook know, our writing follows the calendar of quarterly earnings reports. “Earnings season” is an important part of our investment process, as we are able to check-in on the progress of the companies that we own, as well as management’s expectations for the future of their firm. This quarter, as a generalization, companies continue to perform well. If you have been following the financial press, you would have seen excellent results that have mostly exceeded management guidance but not investor expectations. This has led to some market volatility. Readers will recognize the aggregate sales data for North American companies noted in Figure 1. We have mentioned before that we prefer to review aggregate sales data as it is harder to manipulate than earnings. For a large group of companies, we feel this is a better way to take the temperature of how the North American economy is performing. We also focus on “all listed companies” in North America, rather than a widely used index, like the S&P 5oo for example. We find the large global companies in those types of indices can skew the results from time to time (i.e. the Mag 7 in the current environment) and this could cause us to draw incorrect conclusions from the data as we are trying to assess: the health of “Main Street”.

- So far, 94% of firms have reported, and the results continue to be broadly positive with only Energy posting negative sales growth. This quarter is slower than last quarter but remains higher than other periods over the past year, and the 4%+ quarter on quarter growth remains exceptional.

- Technology and Financials both posted 8% growth rates and were similar last quarter. These are very impressive performances for two huge segments of the economy. It appears that investors do not believe this can continue.

“This means that” it will be interesting to see if the trend continues and weather or not the more cyclical sectors (consumer discretionary, for example) decrease or turn negative in the coming months. Our anecdotal management commentary noted in previous issues of the Outlook indicates that the consumer remains bifurcated.

This is our last week of the Investment Outlook series for 2024. We will spend the rest of the year analyzing, evaluating, and writing for our Annual Reviews and Outlooks, which we will begin publishing on January 10, 2025. The reports will run through to mid February, so please watch for those.

Happy New Year and Best of the Holiday Season to you and your family from the entire Pathfinder Team.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.