Inflation mixed with AI

Last week, we wrote about technology stocks and interest rates causing a change in sentiment. We noted that markets had taken a turn downward so far this month and that the mood around technology stocks had turn clearly negative. Technology stocks can be impacted very quickly both by investor expectations and changes, or potential changes, in interest rates. Chip manufacturing sales have been growing at exceptionally fast rates. However, as a generalization, during recent earnings calls, these companies have downgraded their guidance for the next quarter or two but reaffirmed for the full year. Investors took this as a negative and punished the stocks. At the same time, interest rate expectations were reset somewhat due to sticky inflation data. This has an outsized impact on the valuations of technology stocks because so much of the implied value is usually far off into the future. Higher interest rates and inflation significantly impact the valuation formula. This week, however, we experienced a bit of a positive reversion.

- The rosy outlook analysts and investors have expected of chip makers for recent quarters has been too high but software providers like Alphabet (GOOG US) and Microsoft (MSFT US) released excellent results yesterday. That pushed the market and in particular technology stocks higher. GOOG had good results from both cloud and AI. Cloud division revenue rose 28% and this has caused investors to rethink long-term of chip demand. The stocks ended strong for the week.

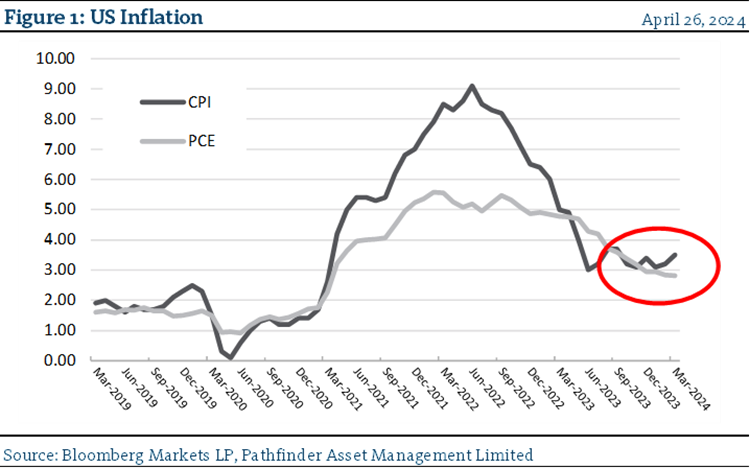

- With respect to inflation, we updated Figure 1 from last week with the most recent Personal Consumption Expenditure data (grey line). The Core PCE (i.e. with the volatile food and energy prices removed) is the preferred measure of inflation of the members of the US Federal Open Market Committee (FOMC). For 2 decades, the committee has targeted 2% as the normal level of inflation in the economy. Inflation is clearly above that level now. We believe it will take an obvious change in the data before the FOMC needs to aggressively reduce administered rates. This should result in risk asset volatility along the way.

“This means that” we remain focused on, and confident in, the long-term operations of the companies that we own. Short-term investor speculation can often lead to volatility (as we have seen over the past month). However, this should be treated as an opportunity for investors who know what they own and why.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.