EQUALLY INVESTED… WHAT THIS MEANS:

We believe we have created a better platform for money management. Our inception as a family office led to the creation of our Equally Invested™ culture: This means that everyone at Pathfinder invests in the same portfolios and funds and pays the same fee as our clients. Also, we (employees), along with our families are the largest investors at Pathfinder, so your portfolios are invested right alongside ours and the people we most care about.

January 2025

Last year, the big debate continued. In 2023, many believed that the US economy was headed into a serious recession. However, there were those (including us) who believed there was potential that the US Federal Open Market Committee (FOMC) could manage a soft landing. Fast forward to 2024 and the recession never came. Instead, the debate was squarely focused on whether the FOMC had, in fact, engineered a soft landing and the coming trajectory of inflation. This is something that we regularly wrote about in our weekly Investment Outlook. In the end, we decided we ultimately needed more data to make a final conclusion but that coming into the fall (i.e. pre-election), the set-up looked pretty constructive. Next year, however, looks very interesting: a new US administration and eye watering technology valuations (still!) will give us lots to consider. In the coming weeks, each of our portfolio managers will publish their mandate reviews and investment outlooks. Please watch for them and reach out with any questions.

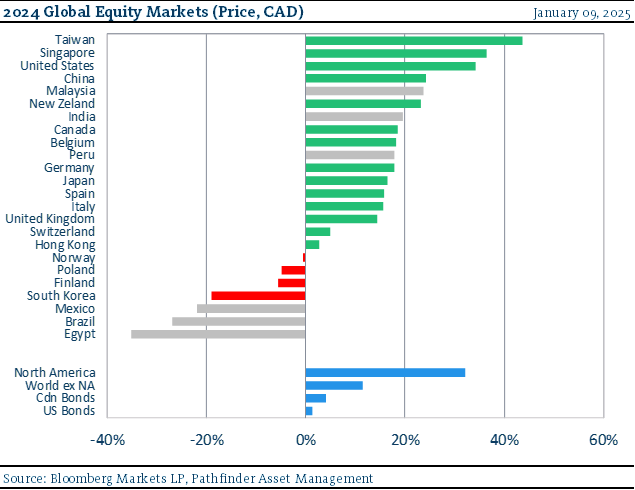

Every year, we select the top and bottom performing equity markets and present them in the chart to the right. Developed markets are highlighted in green & red, Emerging & Frontier in grey. The major regionals, as well as fixed income are in the blue. All returns are in Canadian dollars for comparability. The major markets were mostly all positive again this year. It’s the Emerging Markets that were negative.

We can say with some conviction that strong developed market results were not what many market participants were expecting for 2024 and that valuation around the world remains disconnected.

At Pathfinder, we draw a clear distinction between our Core Portfolios (segregated stocks, bonds and cash) and our Pathfinder Funds (our private specialty pooled funds). The investment profiles of these two “baskets” are quite different. The Core Portfolios are managed to produce broad, equity-like market returns but with less risk. The Pathfinder Funds are specialty mandates and are very different vs. a traditional long-only blue-chip portfolio. We believe that the combination of these two baskets should produce results that are better than broad equity markets alone, for any equity risk level, when combined in various mixes based on client objectives. This is the core belief of Our Investment Thesis. Blending between these two baskets and investment grade bonds, where needed, allows your Wealth Advisor to target essentially any return and risk level that is appropriate for your situation and financial goals. This is also why your financial plan and relationship with the Wealth Advisory Team is so important. Clear communication and expectations should allow us to meet your goals over time.

Our Investment Thesis:

The North America Equity Portfolio is the blue-chip part of your portfolio. It should generate long-run equity returns. We select stocks from a list of high-quality, stable cash-flowing companies and allocate to cash when we feel there is too much risk in financial markets or when stock prices are too high (the two are not the same). We also use a 9% long-run cost of equity capital (similar to the long run return of global equities) as one of the more significant valuation tests when we consider adding a company as an investment into our portfolios. If we are doing our job correctly, we should generate equity like returns with less market risk. We then use the “budgeted risk” saving in this part of the portfolio to allocate capital to the Pathfinder Funds.

The Pathfinder Funds are more aggressive by comparison and are managed for performance (either absolute or relative). Furthermore, each of the risk profiles and investment processes are quite different. This is by design so that we do not introduce a high level of correlation either between each fund or the Core portfolios. As a generalization, the funds are able to use derivatives, leverage, shorting, trade physical commodities, own private companies and typically have higher position concentration. Each fund has its own mandate. A short one-line description is outlined on the next page. Over the coming weeks, you will receive portfolio manager reviews that will dive into more detail about each mandate and fund.

The diversity of risk profiles among the mandates at Pathfinder allows our Team to custom blend a portfolio for each individual client, depending on their needs and investment goals. Less risk taken in the North American Portfolio allows for the budgeted risk to be spent elsewhere. Much of this is accomplished by diversifying asset classes, management strategy and differentiation.

With respect to risk, most people think of risk in terms of losing money. Other more institutionalized investors think of risk in more relative terms – i.e. their portfolio’s return against a benchmark. In the latter case, the absolute return is less important than the relative return. If you have read much of what Pathfinder has written over the years, you would know that we are not big believers in benchmarking. We are more concerned about buying the best companies that we can find and taking a real investment position, rather than hugging widely published index weights (investors can do this cheaply on their own by using Exchange Traded Funds). Thus, risk minimization for us comes from our process, and our process allows us to customize this for each client.

PERFORMANCE:

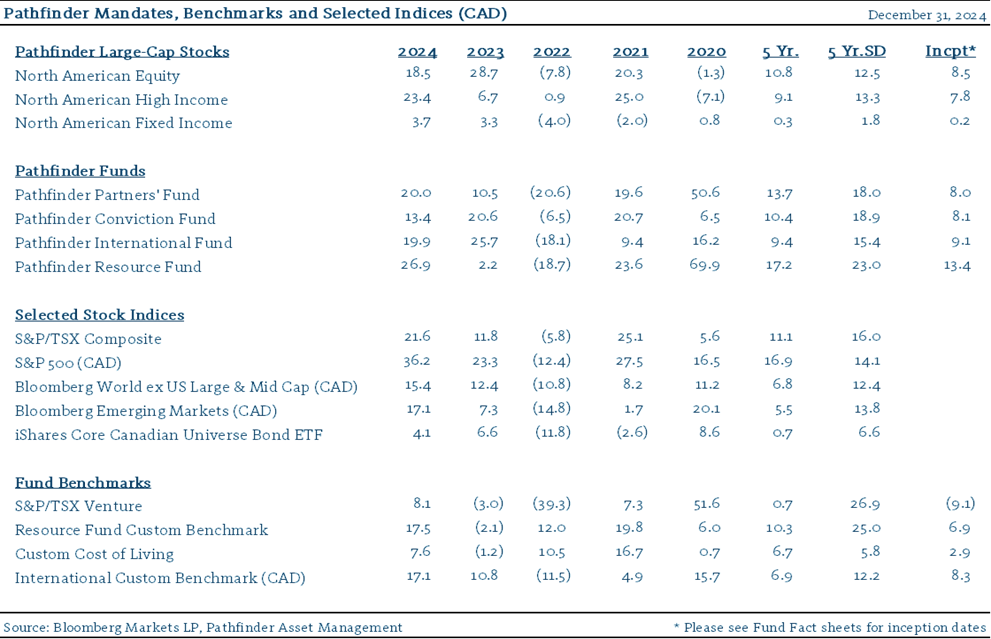

A summary of the Pathfinder mandates and their performance follows:

NORTH AMERICAN EQUITY & HIGH INCOME

This is the blue-chip part of your portfolio. It should generate long-run equity returns with less volatility.

PATHFINDER PARTNERS FUND

This fund invests in high-torque, early-stage companies that have the potential to generate superior returns.

PATHFINDER CONVICTION FUND

This fund invests in assets exhibiting specific qualities that allow for growth beyond inflation.

PATHFINDER INTERNATIONAL FUND

This fund focuses on companies with revenue exposure to developed international & emerging markets.

PATHFINDER RESOURCE FUND

This fund is a concentrated portfolio comprised of natural resource companies.

FINANCIAL PLANNING 2025:

There is a significant amount of diligence, structure, discipline and care that goes into managing the different investment strategies we employ at Pathfinder. We firmly believe that allocation to the investment strategies should be based on a solid foundation, which is your personal financial plan. Pathfinder invests each of our portfolios with the goal of achieving a desired long-term rate of return with an acceptable level of volatility and risk. We believe that families should think about their personal financial goals in a similar way. As our clients know, we provide regular updates where we discuss both the portfolio and what we need to plan for in your financial life. We ask that you start to think about this over the coming weeks and have any questions or updates on your personal financial situation ready for our discussion.

There are a few important financial dates coming up that we would like to keep you abreast of:

January 1st, 2025: Additional Tax-Free Savings Account (TFSA) Contribution Room of $7,000

As our clients will note, in January of each year, we allocate the maximum allowable contribution from non-registered accounts (if available) to the TFSA. If you are a client and don’t have any funds in your non-registered investment account with Pathfinder, and would like to make a TFSA contribution, we will be in touch to arrange this. The TFSA was formally introduced in the 2008 federal budget. Fortunately, unused TFSA contribution room can be carried forward to future years so that starting on January 1st, 2025, the cumulative limit for someone who has never contributed could be as high as $102,000. In other words, if you were at least 18 years of age in 2009, a resident of Canada throughout that period, and have never opened a TFSA before, you could contribute the entire $102,000 to your TFSA as of Jan. 1.

March 1st, 2025: RRSP Deadline

If you want to lower your 2024 tax bill through a registered retirement savings plan (RRSP), you must make your contribution before midnight, March 1. The limit is 18% of the previous year’s income up to a maximum of $32,490. Any unused contributions from previous years can be used in future years (including 2024). Contributions can be deducted from taxable income and grow tax free through investments until they are fully taxed when you withdraw the funds in retirement. We will be in touch to confirm RRSP contribution room and arrange contributions if appropriate.

April 30th, 2025: Personal Income Tax Filing Deadline

It may seem like a long way off but the deadline to file your 2024 income tax is April 30. It might be a good idea to gather and isolate relevant receipts and documents this week before they get mixed up with 2025 receipts and documents. Employers are required to send T4 slips with most of the tax information needed to file by March 1. A good tax plan will leave more of your tax dollars to compound as investments. To our clients: we will be in touch closer to the date, to confirm you are still using the same accountant and will arrange sending your tax package directly to them.

We will be in regular contact throughout the year but would also like to encourage all clients and readers to reach out to us any time with any financial concerns or questions.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.